The Leftovers

Business owners have to think about three money buckets: what's coming in, what's going out, and —most importantly— the leftovers.

If you’re running a business of any size, you’ve got three piles of money to think about:

- How much is coming in;

- How much going out; and

- What's to be done with the leftovers.

The goals for the first two piles are pretty straightforward: maximize (1) and minimize (2). These can’t grow to infinity or shrink to zero, respectively, of course, but that’s a topic for another day.

That third pile, though, is where things get interesting. That third pile, the leftovers, is about opportunity.

And that’s what we’re talking about today.

Opportunity Knocks

In a worst case scenario, the leftovers are survival.

Cash is fuel for a business, and having set aside some of the leftovers is like having a reserve fuel tank that can sustain you when the market takes a dive (see: 9/11, ‘08 financial crisis, COVID). The incoming pile drops to near-zero, while the outgoing pile can’t; the reserves are deployed to keep the motor running. This is also an argument for keeping the outgoing pile as low as possible, so you need less of your leftovers to keep things going for longer.

In a best case scenario, the leftovers are freedom.

Sure, in the survival case, the leftovers are freedom from stress. And that's great. It means you don't have to compromise on your vision, rush a decision, or wonder if you'll make it through the next month.

But more importantly, it’s freedom to experiment. Any experiment needs three things to be a real experiment: a hypothesis, a timeline, and a budget. Leftovers provide that budget without risking self-sufficiency.

That’s what I’m doing with this particular website. I have a timeline (one year) and a hypothesis (people are interested in learning about building their microbusiness), and I can earmark some of my leftovers towards running the project to its completion (the budget).

Each project that you take on like this can uncover a way to either increase the incoming pile or decrease the outgoing pile. Having more leftover cash lets you keep tinkering with your business; just don’t try to run too many projects at once.

Opportunity Costs

Opportunity has a cost, though: the thing you give up to take on that opportunity.

The larger the pile of leftovers, the more opportunities you can fund. The money you make available may not match the time and energy you have available, but that's a whole other topic.

(Quickly: if you set aside enough money for an opportunity, the time and energy required can be shifted to another person; but delegation can be really hard for microbusiness owners.)

But it's also less cash that you can pay yourself, or set aside for depreciation costs (i.e., funds you set aside to replace your equipment). There needs to be an ongoing check on all three piles, to make sure you're optimizing things.

Take, for example, the reserves you set aside in case of an economic downturn. There are a couple of important questions to ask here:

- How much time do you need to be able to subsist without business income? Three months? Two years? Make this too low, and you might run out of cash; set it too high, and you should probably revisit whether this business is actually a going concern.

- How fast and painless is it to ramp down your current expenses, if you have to? There are essential expenses, and there are "nice-to-haves" — it might make sense to lock in to the lowest price possible for the essentials, but aim for flexibility with the rest, cancelling as necessary until income comes back to your expected levels.

This is where budgeting and forecasting come into play. Your accounting software does a great job of showing you historical performance, but financial statements are a lagging indicator of your business' health, and offer no insights on how to deploy your leftover pile in the present or the future.

And that's something I'm working on for you.

More TK!

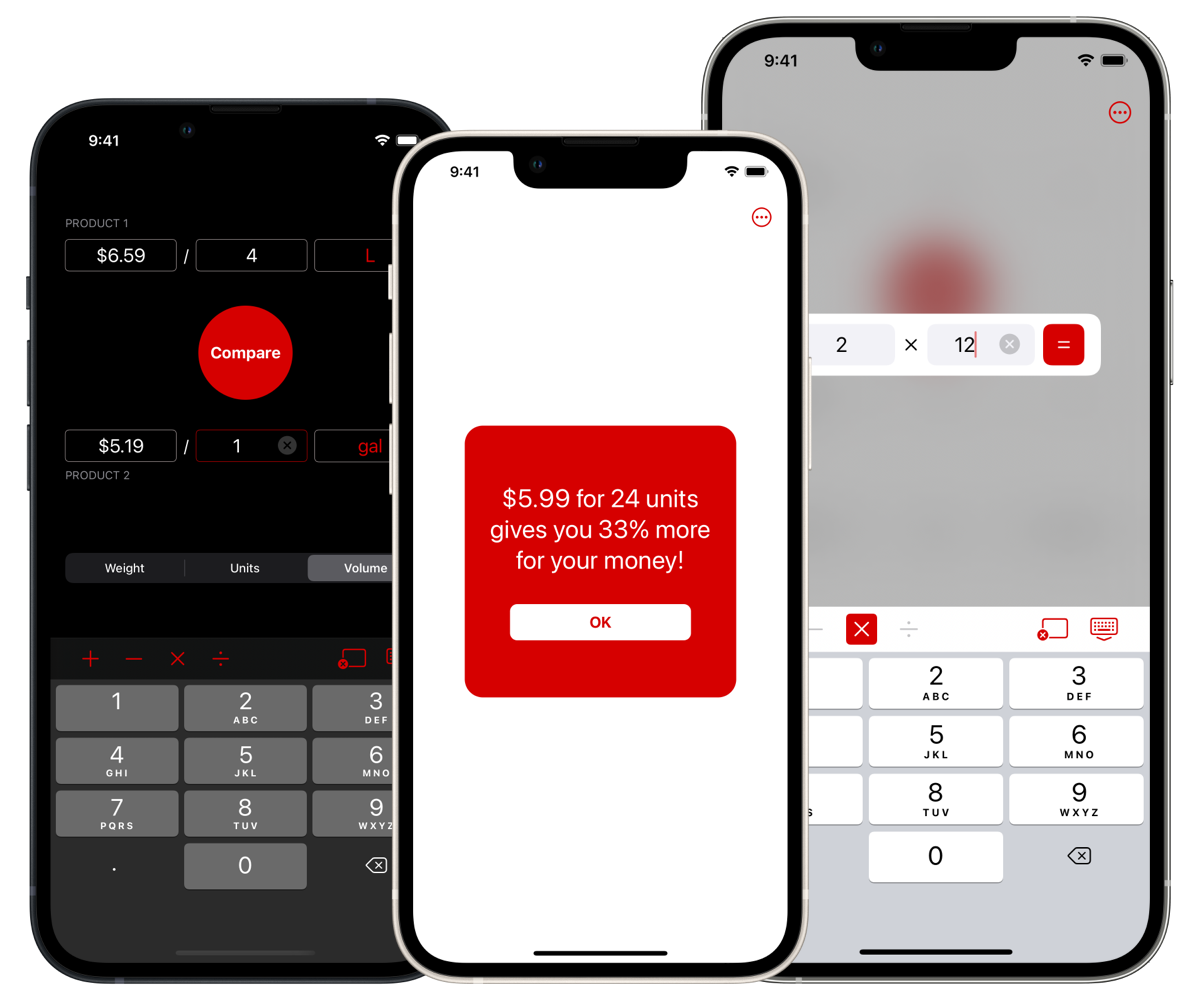

Per for iPhone

Per is the easiest, fastest way to compare price while you shop. It makes shopping decisions easy with its built-in unit converter and calculator, quickly showing you how much you’re getting for your money.